COVID-19’s unfortunate and accelerated spread, has impacted the entire state of New York and in many different ways. West Star Capital is located in Nassau County, Long Island, NY.

There is currently a strictly mandated self quarantine, folks are to work from home (or not at all) and social distancing protocols have been implemented, to hopefully stop the spread of this very contagious virus. As a result, we are witnessing first-hand, local businesses that are either forced to close or struggling to simply stay open or pay employees.

We understand this course of action was put in place to protect everyone from getting and/or spreading this virus and to save lives. Of course, this is goal #1 for our government, slow the spread. However, seeing our neighbors struggle at a time like this, is deeply disheartening. Honestly, it’s heartbreaking. In my 16 years here at West Star, on many occasions I have heard many of my customer’s refer to their business(es) as their “baby.” I’ve come to learn and know so many inspiration traits common in small business owners / entrepreneurs: Entrepreneur’s are passionate about what they do. Entrepreneurs put all their sweat, tears and enthusiasm into their business(es). Entrepreneurs are hurting right now.

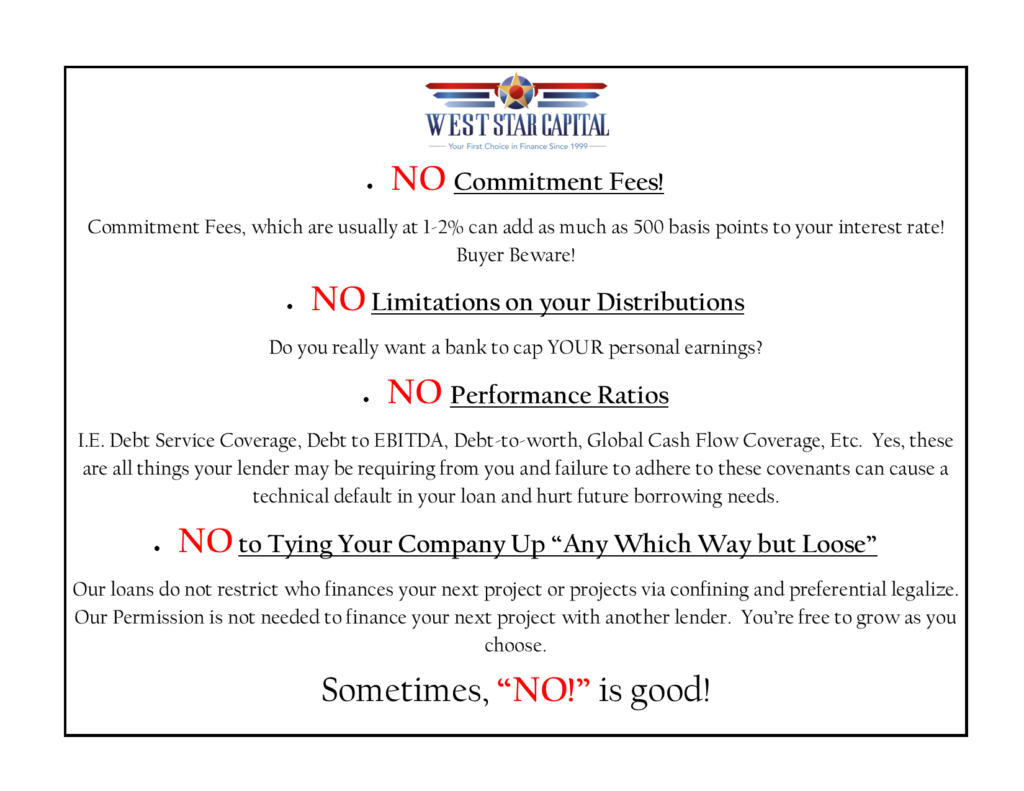

Ray and I were trying to think of a way we could help our community and donate our time to those in need. Well, Ray and I aren’t doctors (lol), so we cannot help out the community in that capacity, but we do have a lot to offer in terms of finance! That is what this blog post today is all about. We would like to donate our time to the local business community, whether you’re an existing customer or not. Ray has over 40 years experience in the financial sector. West Star Capital has been lending for twenty+ years. We are confident that our expertise and guidance will be of great assistance in these times of uncertainty.

As it says above, we are all in this together!!

So, if all the recent goings on are leaving you perplexed about what steps might be best to take, please give us a call. All of the guidance and suggestions we might offer, speaking with you is completely free of charge.

We want our community and neighbors to thrive! We are all in this together!

516.799.9191 or 516.317.7395

[email protected]

[email protected]